Learn How to Cancel a Cheque Correctly to Avoid Payment Errors

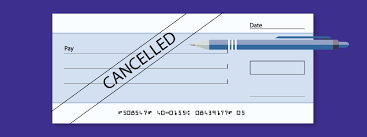

Cheques remain one of the most trusted and widely-used payment instruments in the financial world. However, errors in issuing cheques or misuse of blank cheques can lead to payment discrepancies, financial hassles, or even fraud.

That’s why it’s essential to know how to cancel a cheque properly, especially when you no longer intend to use or issue it. Mastering this simple process can save you from unnecessary complications in your banking transactions.

In this guide, we’ll walk you through the steps involved in cancelling a cheque correctly while also highlighting some useful financial tools like the Bajaj Finserv Insta EMI Card that ease your financial management. Additionally, we’ll address how long-term investments in technology, such as purchasing a fully automatic washing machine under 20,000 can also be made simpler with manageable EMI solutions from Bajaj Finserv.

Why Is It Important to Cancel a Cheque?

Cancelled cheques serve multiple purposes in the financial landscape. Whenever you need to set up electronic mandates for your savings account, apply for loans, or avail EMI facilities, providing a cancelled cheque is often mandatory. However, if a cheque issued by you has mistakes, or you simply wish to withdraw it from circulation, cancelling it prevents any unauthorised usage.

Improperly cancelled cheques can lead to payment errors or, worse, allow misguided parties to misuse them. This makes it imperative to learn how to cancel a cheque correctly, whether for compliance reasons or to prevent financial losses.

Step-By-Step Guide on How to Cancel a Cheque Correctly

Cancelling a cheque is a straightforward process, but it requires precision to ensure no unintended issues arise. Here’s how you can do it:

1. Start with a Blank Cheque

Take a blank cheque leaf from your chequebook. Make sure it is unused and has not been filled in.

2. Write “CANCELLED” Across the Cheque

Use a black or blue pen to write the word “CANCELLED” across the entire cheque. Make sure this word is written in clear, bold letters that cannot be erased or altered.

3. Ensure No Fields Are Filled

Do not enter any other details on the cheque, such as payee name, amount, or signature, as this would defeat the purpose of cancellation.

4. Do Not Strike Off Account Details

Even though the cheque is cancelled, the account details (such as account number, bank name, and IFSC code) should remain legible. These details are often required for financial verifications.

5. Keep a Record

Take a photograph or make a digital note of the cancelled cheque for documentation purposes, especially if it’s being submitted to fulfil financial requirements or loans.

Benefits of Cancelling a Cheque

- Prevents Misuse of Blank Cheques: Writing “CANCELLED” ensures that even if the cheque gets misplaced, it cannot be altered and presented for withdrawals or payments.

- Facilitates Direct Debit Setups: Cancelled cheques are often part of documentation for EMI mandates, and bills where auto-debits need to be enabled.

- Protects Against Payment Errors: Cancelling cheques avoids potential mistakes if you mistakenly issue one with wrong details.

Managing Financial Goals with Bajaj Finserv Insta EMI Card

Taking control of your financial health becomes easier with innovative solutions like the Bajaj Finserv Insta EMI Card. This card empowers you to break down high-value purchases into no-cost EMIs, making expensive items affordable. Whether you’re buying a fully automatic washing machine under 20,000 or upgrading your gadgets, the Bajaj Finserv Insta EMI Card enables easy payments without straining your budget.

What Is the Bajaj Finserv Insta EMI Card?

The Bajaj Finserv Insta EMI Card is a unique financial tool that allows you to shop for a wide range of products and services and convert your purchases into No-Cost EMIs. It eliminates the need for a credit card and ensures that you can access financing instantly, even for big-ticket items.

Key Benefits of the Bajaj Finserv Insta EMI Card

1. No-Cost EMIs

With the Insta EMI Card, you can convert your purchases into manageable instalments without worrying about interest rates.

2. Pre-Approved Loan Amount

The card provides a pre-approved loan amount of up to ₹2 lakh, allowing you to shop confidently for both essential and luxury products.

3. Widespread Usability

The card can be used across a vast network of eligible offline and online partners, making it versatile for all types of transactions.

4. No Processing Fees

Unlike traditional loans, there are no hidden processing fees when you use the Bajaj Finserv Insta EMI Card.

5. Flexible Tenures

You can opt for flexible repayment tenures ranging between 3 to 24 months, giving you ample time to repay your dues without financial stress.

How to Apply for the Bajaj Finserv Insta EMI Card

Applying for the Bajaj Finserv Insta EMI Card is simple and hassle-free:

- Visit the official website at [https://www.bajajfinserv.in/insta-emi-card](https://www.bajajfinserv.in/insta-emi-card).

- Check your eligibility by entering the required basic details.

- If eligible, complete the application process online with minimal documentation.

- Once approved, your Insta EMI Card will be activated digitally, and you can start making purchases immediately.

Combining Financial Convenience and Strategic Planning

Knowing how to cancel a cheque correctly is just one aspect of managing your personal finances. Tools like the Bajaj Finserv Insta EMI Card take financial convenience a step further by enabling you to turn major expenses into manageable monthly payments. If you’re planning on upgrading your home essentials, such as investing in a fully automatic washing machine under 20,000, this card can make the process seamless and affordable.

Effective financial management is all about understanding your options, taking precautions such as cancelling cheques properly, and leveraging tools like the Insta EMI Card to achieve your goals without overburdening your budget. So, take the right steps today and enjoy financial freedom!