Key Inputs Required in a Mortgage Calculator in Dubai

Understanding home financing in the UAE requires clarity on loan structure, repayment timelines, and borrowing capacity, which is why many buyers rely on a mortgage calculator in Dubai to estimate costs before speaking with lenders. These tools simplify complex calculations by using a set of key financial inputs that directly affect monthly payments and total loan value. Knowing what information to enter—and why it matters—helps buyers make more accurate and confident property decisions.

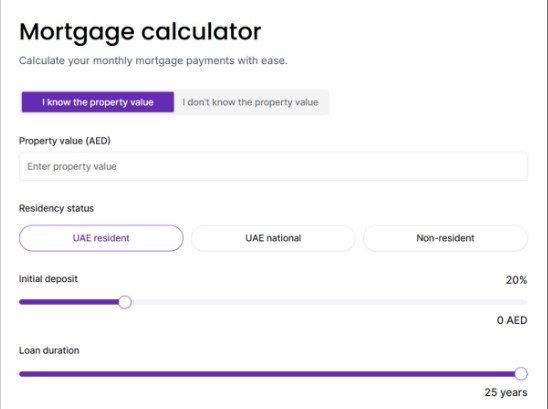

Property Price and Purchase Value

The first and most fundamental input is the property’s purchase price. In a mortgage calculator in Dubai, this figure forms the base for all subsequent calculations, including loan amount and repayment structure. Whether the property is off-plan or ready, the listed value determines how much financing may be required. Accurate pricing is essential, as even small differences can significantly impact monthly installments and interest over time.

Down Payment Percentage

Another critical input in a mortgage calculator in Dubai is the down payment. UAE regulations typically require a minimum down payment that varies based on residency status and property value. Entering the correct percentage helps calculate the actual loan amount needed from the bank. A higher down payment reduces monthly repayments and total interest paid, while a lower one increases borrowing costs.

Loan Tenure or Repayment Period

Loan tenure refers to the number of years over which the mortgage will be repaid. When using a mortgage calculator in Dubai, buyers usually select a tenure ranging from 5 to 25 years. Longer tenures lower monthly payments but increase total interest paid, while shorter tenures raise monthly costs but reduce long-term interest. This input allows users to compare scenarios and choose a repayment plan aligned with their income stability.

Interest Rate Type and Value

Interest rate selection plays a major role in repayment outcomes. A mortgage calculator in Dubai typically allows users to input either a fixed or variable interest rate. Fixed rates offer predictable payments for a set period, while variable rates may change based on market conditions. Entering an accurate interest rate helps estimate realistic monthly installments and assess affordability under different rate scenarios.

Monthly Income and Debt Obligations

Some versions of a mortgage calculator in Dubai include income-related inputs to assess eligibility. Monthly salary, bonuses, or other income sources may be entered alongside existing financial obligations such as personal loans or credit card payments. These inputs help estimate debt-to-income ratios, which banks use to determine maximum loan eligibility and repayment limits.

Mortgage Fees and Associated Costs

Beyond the loan itself, a mortgage calculator in Dubai may account for additional costs such as bank processing fees, valuation charges, and registration expenses. Including these costs provides a more comprehensive estimate of upfront cash requirements. Buyers who overlook these inputs may underestimate the total financial commitment involved in securing a mortgage.

Property Type and Buyer Status

Some tools request information about property type—such as apartment or villa—and buyer status, including first-time buyer or investor. In a mortgage calculator in Dubai, these inputs can influence applicable loan-to-value ratios and regulatory requirements. Accurate selection ensures the calculator reflects realistic financing conditions based on the buyer’s profile.

Currency and Payment Frequency

While most mortgages are calculated in AED, certain calculators allow users to adjust payment frequency or currency assumptions. A mortgage calculator in Dubai may offer monthly, bi-weekly, or annual repayment views to help buyers understand cash flow impact. These options provide flexibility when planning long-term financial commitments.

Scenario Comparison and Planning

One advantage of using a mortgage calculator in Dubai is the ability to compare multiple scenarios quickly. By adjusting inputs such as down payment, tenure, or interest rate, buyers can visualize how changes affect affordability. This comparison supports better negotiation with lenders and more informed property selection decisions.

Conclusion

Mortgage calculators are valuable planning tools because they translate financial inputs into clear repayment estimates. By entering accurate data on price, down payment, tenure, interest rates, and related costs, buyers gain a realistic view of their borrowing capacity and long-term obligations. For anyone preparing to buy property in Dubai, understanding these inputs is a crucial step toward making confident and financially sound real estate decisions.